Tax Rate Reit Dividend . Reit dividends are usually taxed at the ordinary. reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. there are two primary differences in reit dividend taxation compared to other investable assets:

from seekingalpha.com

there are two primary differences in reit dividend taxation compared to other investable assets: Reit dividends are usually taxed at the ordinary. reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return.

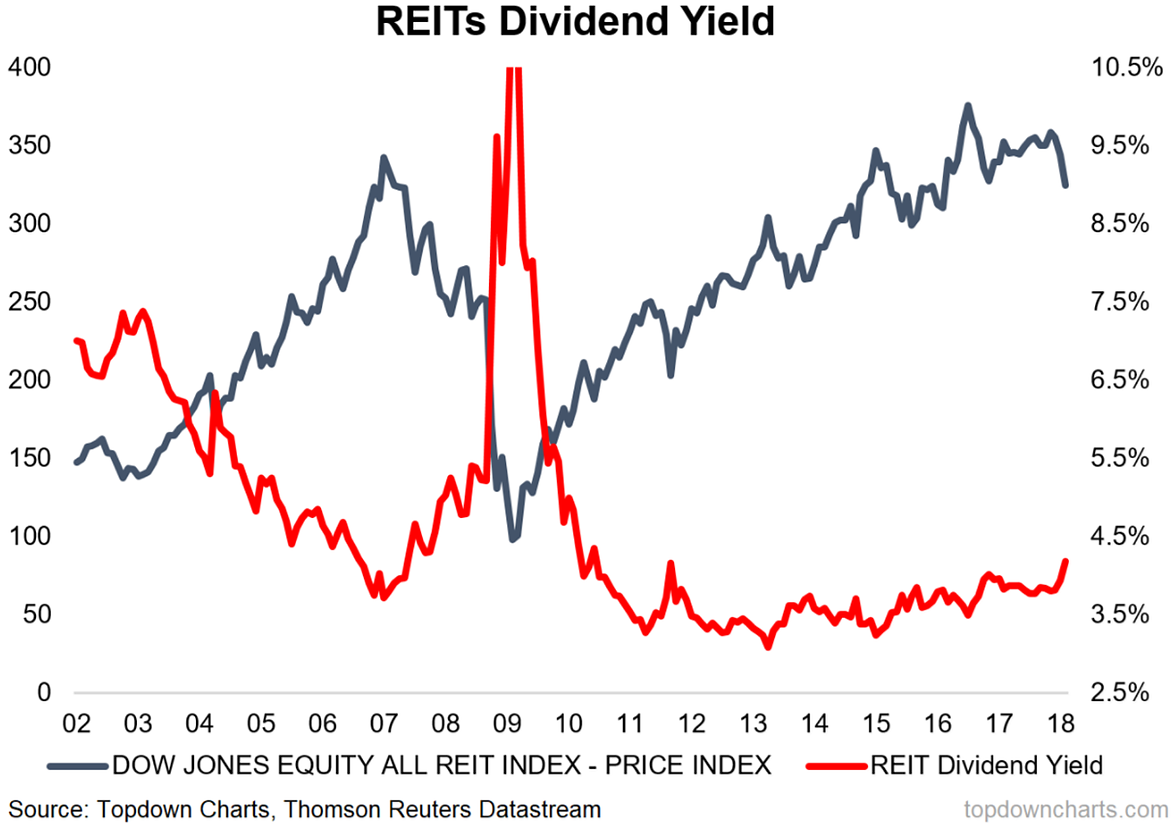

Chart Of The Week U.S. REIT Dividend Yields Seeking Alpha

Tax Rate Reit Dividend reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. there are two primary differences in reit dividend taxation compared to other investable assets: Reit dividends are usually taxed at the ordinary. reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return.

From efinancemanagement.com

Dividend Decisions Define, Objective, Good Policy, Types eFM Tax Rate Reit Dividend reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Reit dividends are usually taxed at the ordinary. there are two primary differences in reit dividend taxation compared to other investable assets: Tax Rate Reit Dividend.

From nomoneylah.com

Guide to invest in Singapore REIT (SREIT) All You Need to Know! No Tax Rate Reit Dividend reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Reit dividends are usually taxed at the ordinary. there are two primary differences in reit dividend taxation compared to other investable assets: Tax Rate Reit Dividend.

From ibb.co

2022mREITDividendTaxClassifciations hosted at ImgBB — ImgBB Tax Rate Reit Dividend reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. there are two primary differences in reit dividend taxation compared to other investable assets: Reit dividends are usually taxed at the ordinary. Tax Rate Reit Dividend.

From seekingalpha.com

Chart Of The Week U.S. REIT Dividend Yields Seeking Alpha Tax Rate Reit Dividend Reit dividends are usually taxed at the ordinary. reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. there are two primary differences in reit dividend taxation compared to other investable assets: Tax Rate Reit Dividend.

From www.youtube.com

Understanding REITs Dividend Growth Rate REIT Money Tree YouTube Tax Rate Reit Dividend reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Reit dividends are usually taxed at the ordinary. there are two primary differences in reit dividend taxation compared to other investable assets: Tax Rate Reit Dividend.

From www.mrmarvinallen.com

Are REIT Dividends Qualified? Marvin Allen Tax Rate Reit Dividend reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Reit dividends are usually taxed at the ordinary. there are two primary differences in reit dividend taxation compared to other investable assets: Tax Rate Reit Dividend.

From www.reddit.com

REIT dividend aristocrats list r/dividends Tax Rate Reit Dividend Reit dividends are usually taxed at the ordinary. reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. there are two primary differences in reit dividend taxation compared to other investable assets: Tax Rate Reit Dividend.

From seekingalpha.com

How Tax Efficient Are Your REITs? Seeking Alpha Tax Rate Reit Dividend there are two primary differences in reit dividend taxation compared to other investable assets: Reit dividends are usually taxed at the ordinary. reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Tax Rate Reit Dividend.

From www.fool.com

What Is the REIT Dividend Tax Rate? The Motley Fool Tax Rate Reit Dividend Reit dividends are usually taxed at the ordinary. reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. there are two primary differences in reit dividend taxation compared to other investable assets: Tax Rate Reit Dividend.

From seekingalpha.com

The Taxman Cometh REIT Tax Myths Seeking Alpha Tax Rate Reit Dividend reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. there are two primary differences in reit dividend taxation compared to other investable assets: Reit dividends are usually taxed at the ordinary. Tax Rate Reit Dividend.

From arrived.com

REIT Tax Advantages Why Investors Choose REITs Arrived Tax Rate Reit Dividend there are two primary differences in reit dividend taxation compared to other investable assets: Reit dividends are usually taxed at the ordinary. reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Tax Rate Reit Dividend.

From reit.com

Guide to Equity REITs Tax Rate Reit Dividend there are two primary differences in reit dividend taxation compared to other investable assets: reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Reit dividends are usually taxed at the ordinary. Tax Rate Reit Dividend.

From www.mortgagecalculator.org

REIT TaxEquivalent Distribution Calculator Estimate Tax Rate Reit Dividend there are two primary differences in reit dividend taxation compared to other investable assets: Reit dividends are usually taxed at the ordinary. reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Tax Rate Reit Dividend.

From www.freeagent.com

UK dividend tax rates and thresholds 2021/22 FreeAgent Tax Rate Reit Dividend Reit dividends are usually taxed at the ordinary. there are two primary differences in reit dividend taxation compared to other investable assets: reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Tax Rate Reit Dividend.

From medium.com

How To Value REITs Using Dividend Yield Comparison by Tax Rate Reit Dividend Reit dividends are usually taxed at the ordinary. reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. there are two primary differences in reit dividend taxation compared to other investable assets: Tax Rate Reit Dividend.

From www.nuveen.com

Tax benefits and implications for REIT investors RealAccess issue no Tax Rate Reit Dividend reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Reit dividends are usually taxed at the ordinary. there are two primary differences in reit dividend taxation compared to other investable assets: Tax Rate Reit Dividend.

From www.simplysafedividends.com

The Most Important Metrics for REIT Investing Tax Rate Reit Dividend reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Reit dividends are usually taxed at the ordinary. there are two primary differences in reit dividend taxation compared to other investable assets: Tax Rate Reit Dividend.

From www.multihousingnews.com

2022 REIT Dividend Yields MultiHousing News Tax Rate Reit Dividend there are two primary differences in reit dividend taxation compared to other investable assets: reit dividends can be taxed at different rates because they can be allocated to ordinary income, capital gains and return. Reit dividends are usually taxed at the ordinary. Tax Rate Reit Dividend.